we TARGET high yield returns for private investors

At the Creative RE Capital Fund, we specialize in matching accredited private investors with carefully selected short-term lending opportunities that target steady returns while striving to keep risk to a minimum.

The Creative re capital fund

Whether you want to broaden your holdings, protect against market swings, or enhance passive income, the Creative RE Capital Fund’s private lending model provides an alternative asset class built on security, transparency, and strong performance. Please note no return is guaranteed and any investment is subject to risk.

Focused on Providing Consistent, High-Yield Returns. The fund goal is to provide strong annualized interest rates with predictable quarterly earnings. No guessing while limiting any volatility.

Real Asset-Backed Security. Each loan is backed by real estate collateral, with clear loan-to-value parameters and conservative underwriting.

Short-Term Liquidity. Typical Asset investments last between 90 and 180 days.

Vetted Borrowers & Projects. Our borrower focus Will be on seasoned operators—developers, flippers, and builders—with a proven track record of performance.

Transparent Reporting. Investors receive regular updates, project status reports, and access to deal dashboards so you're never in the dark.

Passive Investing, Active Oversight. We handle the origination, servicing, borrower communication, and legal Items. this allows You to just collect returns. true passive investing!

The Creative RE Capital Fund Investor Slide Deck

Have Questions?

Book a call with us. Simply pick a date and time on our calendar that is convenient for you.

INVESTOR FAQ's

What Is An Accredited Investor?

Under Rule 506(c) of the United State Securities and Exchange Commission (SEC), of which the Creative RE Capital Fund operates, fund subscribers must be able to demonstrate, and provide evidence that they are accredited before a fund may accept them as a fund subscriber.

Individuals (i.e., natural persons) may qualify as accredited investors if they meet any of the following wealth, income, or financial sophistication criteria:

Individual Investor Financial Criteria

Net worth over $1 million, excluding primary residence (individually or with spouse or partner).

Income over $200,000 (individually) or $300,000 (with spouse or partner) in each of the prior two years, and reasonably expects the same for the current year.

Professional Criteria

Investment professionals in good standing holding the general securities representative license (Series 7), the investment adviser .representative license (Series 65), or the private securities offerings representative license (Series 82).

Directors, executive officers, or general partners (GP) of the company selling the securities (or of a GP of that company).

Any “family client” of a “family office” that qualifies as an accredited investor.

For investments in a private fund, “knowledgeable employees” of the fund.

More information on how the SEC defines "accredited investors" can be found here: https://www.sec.gov/resources-small-businesses/capital-raising-building-blocks/accredited-investors

What Is the Fund’s Structure & Strategy?

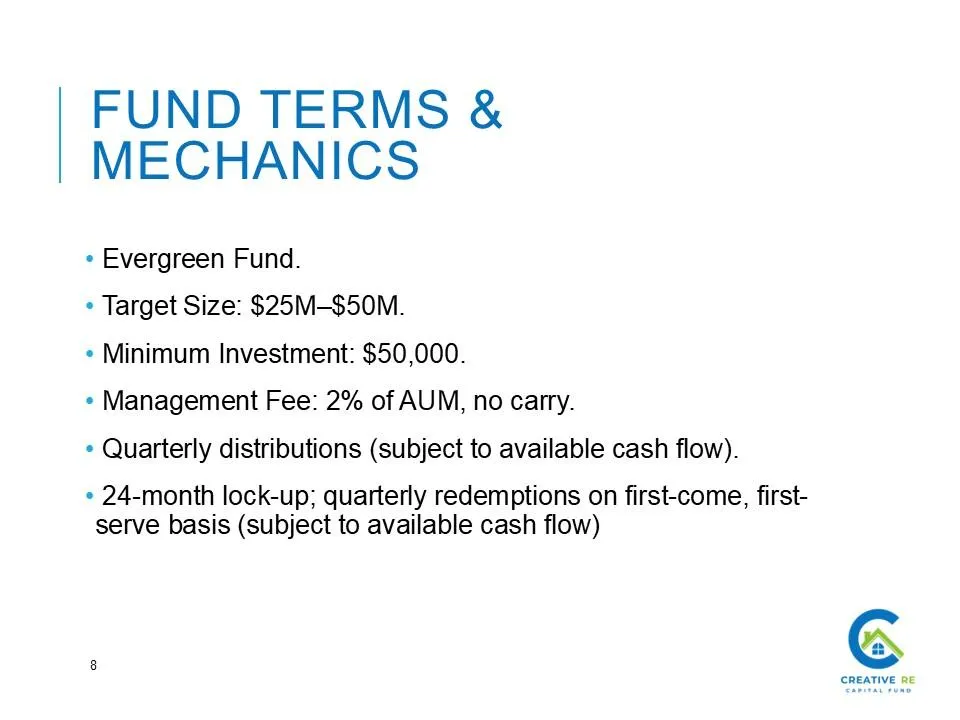

Open-end, evergreen Delaware LLC offered under Rule 506(c)

Target raise: $25 M (up to $50 M at Manager’s discretion)

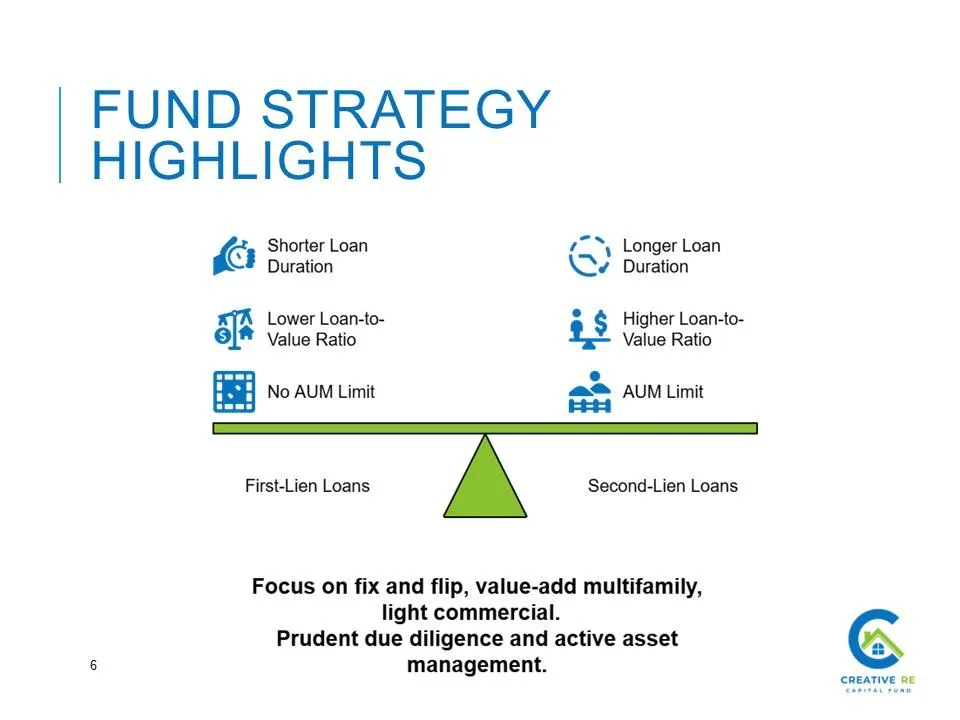

Strategy: short-term, first-position hard-money loans (6–12 mo., ≤75% ARV) plus second-lien creative finance (≤25% AUM; combined CLTV ≤85%)

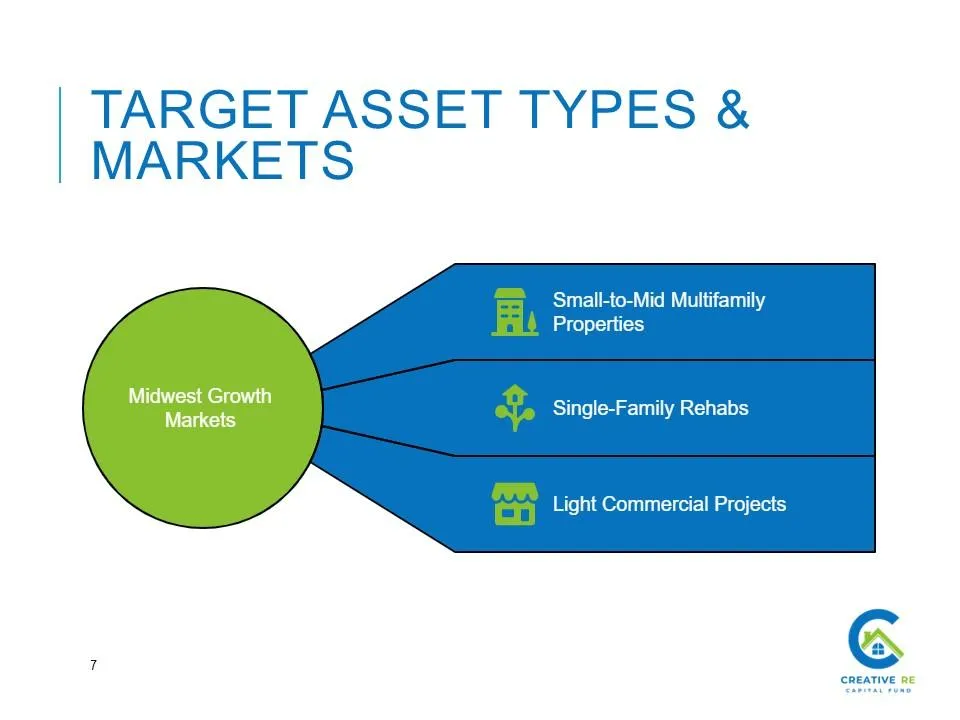

Focus on fix-and-flip, value-add multifamily, and light commercial in high-growth Midwest markets

What Are the Fees & Distributions?

Management fee: 2% AUM, paid monthly

Distributions: 100% of net income (after fees/expenses) is paid pro rata to Members quarterly

Carry or Performance Fee: None—no waterfall or profit split beyond AUM fee

How Do I Invest & What’s the Minimum?

Minimum subscription: $50,000 (waivable by Manager)

Accredited investors only (506(c) verification required)

Subscription funds held in a non-interest–bearing account until deployed

How Does Liquidity & Redemption Work?

Lock-Up: 24 months (hardship exceptions may apply with Manager approval)

Post-lock-up: 90 days’ written notice per redemption request

Quarterly redemptions capped at 25% of an individual’s capital and 10% of total fund capital per fiscal year

How & When Are Distributions Made?

Frequency: Quarterly, within 30 days after quarter-end

Reinvestment Option: Members may elect to auto-reinvest distributions at the current NAV

Manager may adjust or suspend reinvestment at its discretion

How Is the Fund Priced & Valued?

Initial Unit Price: $1,000

NAV Updates: Monthly, based on the stated value of assets and loan performance

Full transparency with monthly NAV and portfolio metrics

What Are the Fund’s Risk Controls?

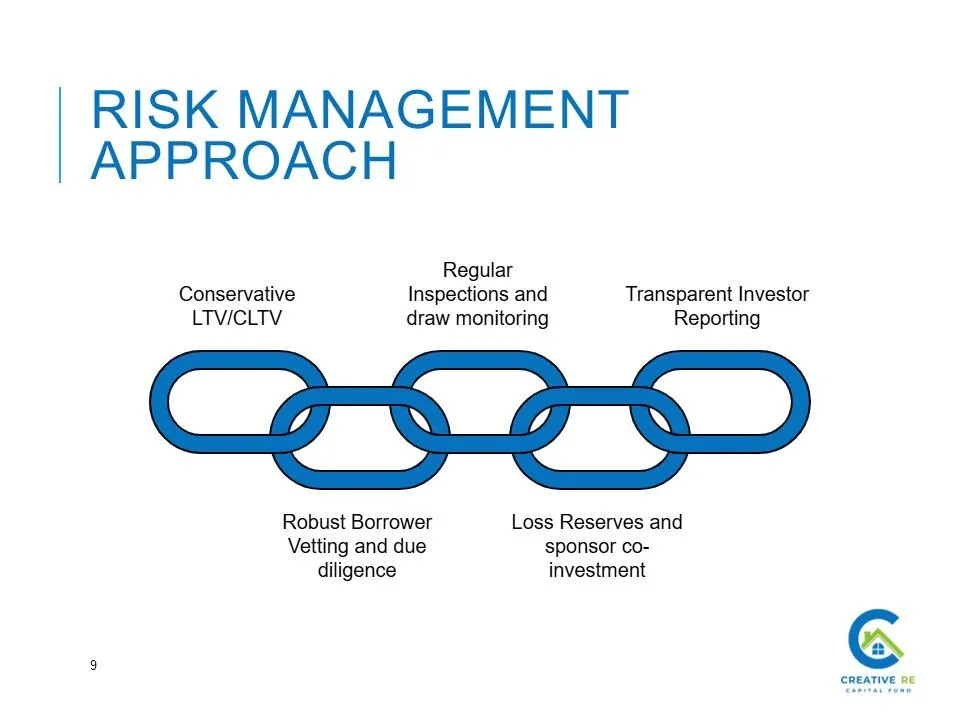

Conservative LTV/CLTV: First-lien ≤75% ARV; combined ≤85% CLTV for seconds

Due Diligence: BPO/appraisals, sponsor track records, site inspections

Ongoing Oversight: Draw monitoring, property reviews, and loss reserves

Sponsor co-investment aligns interests

What Reporting & Governance Do Investors Receive?

Quarterly Reports: Performance, asset-level updates via secure portal

Annual Financials: Prepared by an independent accountant (audits at Manager’s discretion)

Governance: Manager-managed with limited Member votes (e.g., removal for cause, major amendments)

Can I See the Fund’s Pipeline & Deal Flow?

Updates on committed vs. deployed capital

Key pipeline metrics: number of loans in underwriting, average hold period, weighted average coupon

Case studies of closed transactions available on request

Get In Touch

Hours

Mon - Fri 9:00am - 5:00pm

Saturday - 9:00am - 12:00pm

Sunday - CLOSED

Contact Us

Call (855) 560-3863

Email: [email protected]

Address: 1209 Orange Street, Wilmington DE 19801

Call: (855) 560-3863

Email: [email protected]

Site: http://www.creativerecapitalfund.com/